The tourism industry is eagerly anticipating the post-pandemic ‘Revenge Travel‘ trend as the World Health Organization (WHO) officially ends COVID-19 as a global health emergency in 2023 and the world steps up the removal of travel restrictions. Will China, the world’s largest outbound travel market prior to the pandemic, be one of these participants? If so, how have their tourists changed since COVID-19, and what changes will countries need to make in order for them to pick their destination?

Reviving the Silk Road TLDR; China was a major outbound travel market prior to the COVID-19 pandemic, Chinese tourists are highly tech-savvy, prefer Chinese food to Western-style foods, travel outside of western holiday seasons. They are interested in leisure and sightseeing, shopping, and customized products and services. Domestic travel increased significantly during the Chinese New Year and Labor Day holidays, but long-distance travel is lagging behind.

The COVID-19 pandemic has had a profound impact on Chinese tourist behaviour, leading to a new generation of sophisticated Chinese visitors. Chinese tourists are even more digitally-savvy, shopping remains a primary travel motive, are they are shifting their vacation preferences from quantity to quality experiences, with health and safety concerns still a factor. KOLs have lost favor with the Chinese public, leading to the shift to KOC marketing.

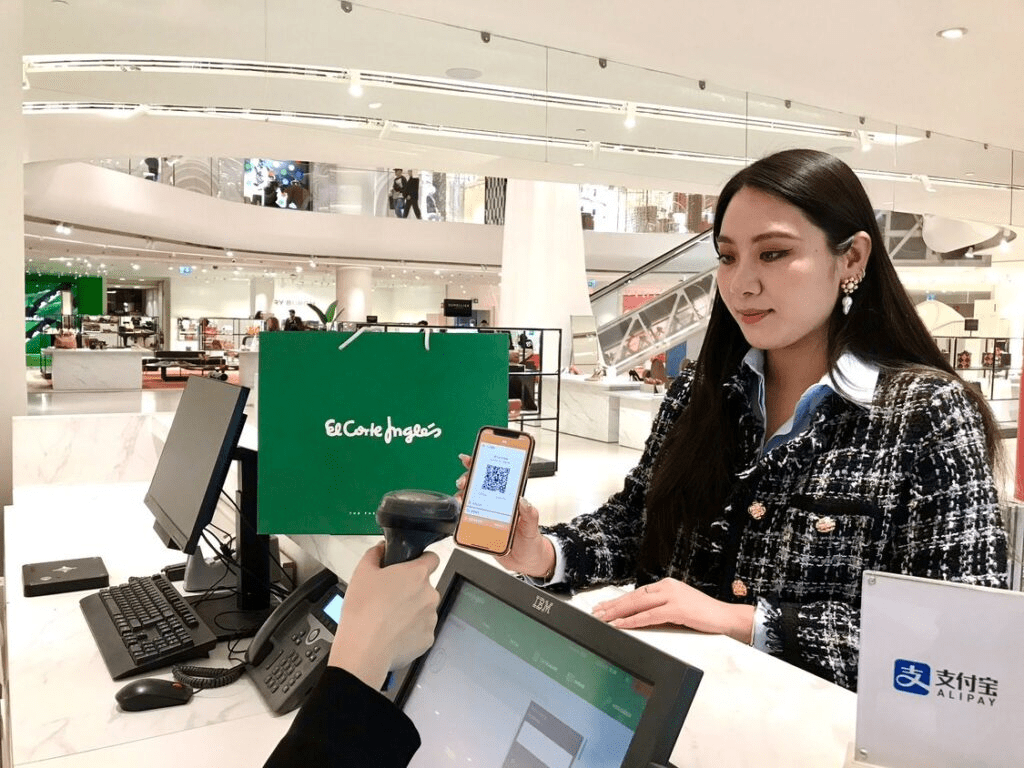

China is a key inbound tourism source market for the UAE and UAE’s appeal to Chinese luxury travelers is growing. The UAE hospitality industry must be prepared for a surge in Chinese tourists following China’s reopening, including ensuring Mandarin speakers and observing changes in the habits and patterns of Chinese travelers. UAE tourism stakeholders must ensure that WeChat Pay and Alipay are accepted by tourism service providers to provide the best visitor experience to Chinese tourists.

Chinese Tourism pre-COVID

Prior to the COVID-19 epidemic, China was fast becoming one of the world’s major outbound travel markets. According to McKinsey, Mainland China has the world’s largest outbound travel market in terms of both trips and total cost. In 2019, Mainland Chinese tourists took 155 million outbound journeys, spending a total of US$255 billion. China was a vital source market for any tourism business, with double-digit annual growth and Chinese travelers spending more per trip than tourists from any other country (approximately USD 970). Prior to COVID, the top 10 destinations for Chinese outbound tourists were Thailand, Japan, Vietnam, Republic of Korea, United States, Singapore, Malaysia, Cambodia, Russia, and Indonesia. They accounted for a sizable amount of inbound tourism to these destinations, accounting for 28 percent of visitors to Thailand and 30 percent of visitors to Japan.

Chinese Tourists (pre-COVID): A Profile

So, how were Chinese tourists before the pandemic? Large group trips and shopping were frequently linked with Chinese tourists. China is the world’s second most populous country (India surpassed them this year), with an ever-expanding middle class with increasing disposable income, accounting for more than half of the population, primarily concentrated in wealthy areas of the South-East and East, in major cities such as Shanghai, Beijing, and Guangzhou. Even though just 13 percent of Chinese residents have passports, the expanding Chinese middle class has provided a tremendous potential for the global travel industry.

Women led Chinese travel, accounting for 53 percent of all Chinese tourists. It was also dominated by millennials and Generation Z, with Chinese tourists aged 15 to 34 accounting for 55% of the market. Chinese tourists were well-known for preferring all-inclusive group excursions with pre-planned itineraries and tour leaders. In 2016, 59 million Chinese traditional package tours were booked through travel agencies, accounting for 47 percent of the total market share. Traveling on group package trips also allowed Chinese tourists to overcome linguistic difficulties, with less than 1 percent of Chinese mainland residents conversant in English. Family was also a big factor in their travel decisions, with 51 percent of Chinese visitors traveling with family, which according to experts is closely tied to China’s collectivist culture.

Because their main travel patterns fell outside of traditional western holiday seasons, Chinese travelers were considered as excellent non-peak season possibilities. Chinese visitors typically travel during the Golden Week holidays, which include Chinese Lunar New Year (January/February), Labor Day (May 1), and National Day (May 1). (October 1). Over half of Chinese tourists plan a four-day to one-week excursion to nearby short-haul Asian locations based on these public holidays. Chinese tourists are also perceived as highly tech-savvy, with widespread use of smart phones and portable devices, including a 73 percent smartphone penetration rate. Most B2C businesses have established mobile applications, and mobile payments via Alipay or WeChat Pay are very widespread.

The Chinese outbound tourist’s major interests while in the destinations were leisure and sightseeing. Shopping accounts for 39 percent of Chinese tourist spending patterns while abroad, whereas cultural recreation and amusement activities account for 12 percent. Chinese tourists want customized products and services due to their higher purchasing capacity. Private excursions with only family or friends have grown in popularity among Chinese travelers. The vast majority of Chinese tourists (70 percent) slept in mid-range or low-cost hotels, and it was regarded as merely another place to sleep since they want to spend more time visiting the region. However, a hotel’s branding and reputation, as well as its comfort and facilities, are important factors in Chinese tourists’ booking decisions, whereas pricing is less important. Food alternatives are especially important for Chinese tourists, who may be unsatisfied with a lack of food and beverage services that suit their preferences. According to research, Chinese tourists have different eating and drinking habits than most western tourists, preferring Chinese food to some local foods while visiting a destination and believing Western-style foods that are too sweet, fried, unhealthy, or include too many uncooked or cold dishes are unhealthy.

Reopening of Chinese Tourism

After being banned for nearly three years, Chinese tourists are raring to revive their wanderlust. According to the McKinsey Survey of Chinese Tourist Attitudes, 40 percent of Chinese visitors said they plan to travel abroad for their next vacation. The China Outbound Tourism Research Institute also supports this. This year, 58 million Chinese visitors will go internationally, with 18 million traveling in the first half of 2023, followed by 40 million in the second half.

China quickly lifted its travel restrictions, both domestically and internationally, in the first few months of 2023. Cross-city travel restrictions, border closures, and quarantine requirements for international arrivals in China were eliminated in January. Domestic travel increased significantly during the Chinese New Year holidays, with 308 million domestic trips recorded, generating RMB 376 billion (US$54 billion) in tourism income. Chinese Labor Day also saw a surge in domestic tourism. According to the Chinese Ministry of Culture and Tourism, 274 million domestic visits were taken countrywide, with income of RMB 148 billion (US$21.4 billion).

Long-distance travel, on the other hand, is lagging behind the domestic tourism boom. According to Fitch Ratings, Chinese airlines handled only 2.24 million international passengers in Q1 2023, accounting for barely 12 percent of the total in 2019. This could be explained by operational challenges, with many Chinese residents facing lengthy delays in renewing passports that expired during the pandemic. According to McKinsey, 20 percent of Chinese travellers had passports expire during the pandemic. Furthermore, Chinese airline capacity has yet to fully recover from the 2020 border shutdown. As airlines progressively restart flights, budgeted capacity for May 2023 is 64% lower than 2019 levels. However, after airlines increase capacity, it is projected that the pandemic’s pent-up demand would translate into quickly increasing numbers of outbound travelers, reaching pre-COVID levels in early 2024. However, these visitors are expected to be distinct from the previously known Chinese outbound tourism prior to the pandemic.

Chinese tourist behaviour changes since COVID

The COVID-19 pandemic had a profound impact on the world, causing a variety of modifications in attitudes and behaviors. The globe rightfully got more health and hygiene conscious, placed a greater emphasis on mental health, and accelerated the adoption of digital transformation and technology by several years. In terms of travel, it rekindled domestic tourism within a destination and reemphasized the importance of sustainability in travel. So, what about the Chinese visitor? It appears that the epidemic has influenced new Chinese travel choices while also speeding emerging pre-COVID patterns, resulting in a new generation of sophisticated Chinese visitors who will enter the global post-COVID tourism market.

Chinese Travel Demographics

In terms of the Chinese tourist demography, the balinghou (post-1980s) and jiulinghou (post-1990s) millennials (approx. 400 million people) will continue to rule the roost. Having said that, some experts have recognized a ‘Third Wave‘ group of Chinese travelers over the age of 55, which is expanding faster than the majority of youthful and middle-aged visitors. The ‘jiulinghou’ millennials are reported to be more open-minded, rebellious, and individualistic, which extends to their travel tastes. They have new reasons to travel that go beyond the conventional drives of shopping and sightseeing, preferring vacations related to experience-seeking where they can revel in nature, try local cuisine, and participate in leisure activities.

Fully Independent Traveler (FIT)

The epidemic has hastened the trend of Chinese outbound travelers toward autonomous travel and trip preparation. Prior to COVID, surveys conducted by the China Tourism Academy / Data Centre of the Ministry of Culture and Tourism revealed a decrease in desire to engage in a group tour when traveling abroad. However, after COVID-19, more Chinese visitors have chosen independent travel, which gives them more control over their itinerary and lowers their exposure to enormous crowds. This is not to argue that Chinese group excursions are doomed. To avoid any potential hazards, package trips will most likely remain popular among some Chinese tourist groups, such as older visitors and persons visiting non-traditional destinations. However, younger generations of Chinese travelers are increasingly flying solo, preferring to take public transportation or rent a car at the destinations.

Even more digitally-savvy

Chinese inhabitants are among the world’s most digitally sophisticated, with mobile technologies and social media at the center of their everyday life. They are becoming increasingly connected, utilizing mobile phones for everything from WeChat, Weibo, Mafengwo, to Douyin, and digital applications have now become crucial tools for Chinese travelers when looking for information, sharing trip moments, and booking tourism services. This affects how they pay for their vacation experiences as well. According to Neilsen, 65 percent of Chinese travelers used mobile payment services while traveling abroad, compared to 11 percent of non-Chinese tourists.

Still big spenders

Prior to the epidemic, Chinese tourists were known in the retail industry for their large spending habits and desire for high-end experiences. While the desire for new experiences has increased, shopping remains a primary travel motive for Chinese outbound travelers. According to UBS, the average transaction value of Chinese visitors in Europe in March 2023 was 28 percent more than in 2019. According to Morgan Stanley, China’s reopening will increase global luxury goods sales by 20 percent in 2023. It was expected that the rise in Hainan Island would lead to a decrease in worldwide luxury shopping, since the island became a duty-free shopping center for China, attracting wealthy Chinese tourists at a time when foreign trips were almost impossible. However, a 25 percent to 45 percent price difference between fashion and leather products in mainland China and Europe is pushing Chinese shoppers to board another plane. It is nevertheless expected that the Chinese tourist spending focus would shift further toward purchasing high-quality local resources during travels that are unique or, at the very least, not available in China.

Evolving destination preferences

Because of the pandemic, Chinese tourism has become more localized, with more domestic visits and regional travel within Asia. According to Fliggy, Thailand has benefited greatly from this, as it is the top destination for Chinese clients, with Thailand’s Deputy Prime Minister Anutin Charnvirakul indicating that he expects up to 10 million Chinese tourists to visit Thailand in 2023, up from the prior objective of 5 million. According to McKinsey, Chinese tourists are less interested in visiting Europe than in previous years. This could coincide with the fact that flights from China to Europe are today up to 80 percent more expensive than they were before the outbreak. According to experts, Chinese visitors are shifting their vacation preferences from quantity (seeing more than three countries per trip at a low cost) to a greater emphasis on quality experiences, based on local culture and nature.

Health and Safety Concerns

The pandemic emphasized the importance of health and safety precautions in travel, and Chinese tourists are still concerned about this issue. According to Bloomberg, despite the sudden relaxation of restrictions, roughly 40 percent of Chinese travelers are not planning to travel abroad this year, with health concerns cited as a factor. Furthermore, post-COVID trends in Chinese travelers have pointed to rural destinations with low flow density combined with natural scenery, which are less crowded and provide ample opportunities for social distancing. This complements international destinations like New Zealand, which has seen an increase in Chinese tourist bookings. New Zealand is frequently associated with beautiful natural scenery, low population density, and, more recently, its successful COVID-19 response. Overall flight seat capacity between China and New Zealand is now 79 percent of what it was before the pandemic. A well-regarded COVID-19-safe environment appears to be giving Chinese travelers confidence in destination countries and encouraging them to book trips.

Travel Decision Making Influence

Many sources claim that the once-powerful Key opinion leaders (KOL) marketing era in China is over. While tourism boards have previously used KOLs, They believe KOLs, such as celebrities, musicians, and actors, have lost favor with the Chinese public as a result of influencer fatigue and notable scandals. According to Highsnobiety, the engagement rates for the top 50 traditional fashion KOLs on Weibo, WeChat, and Douyin have been consistently stagnant or declining.

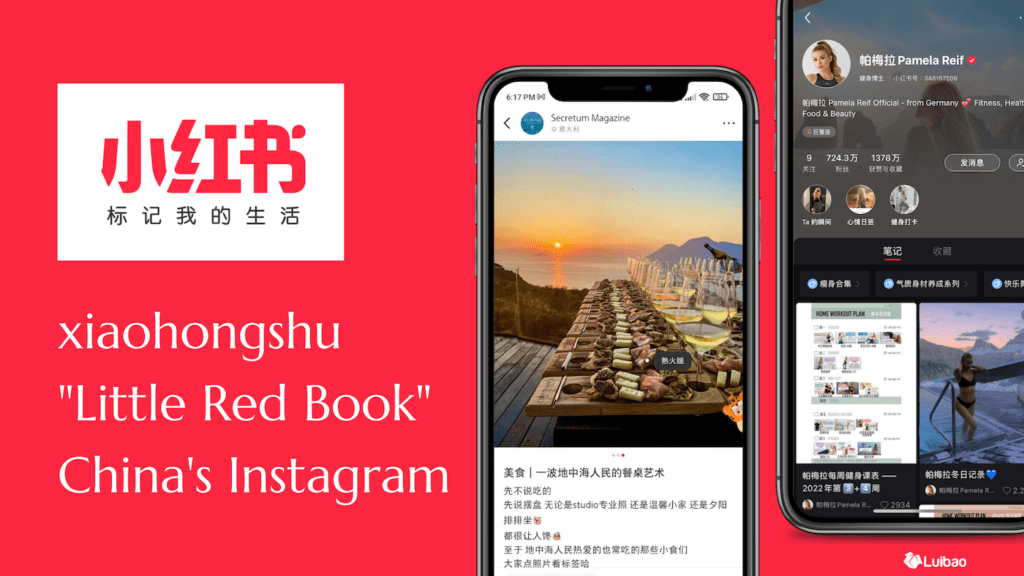

Instead, Key Opinion Customers (KOCs), who have efficient organic reach among friends, family, and colleagues, are gaining clout, particularly among China’s Gen-Z, who discover products and brands through friends and the internet in 69 percent of cases. Most savvy Chinese residents regard reviews conducted by KOCs as more authentic and reliable than those conducted by paid KOLs. The pandemic years are thought to have accelerated the shift from KOL to KOC marketing. In fact, during the pandemic years, a new generation of creative tastemakers known as Cultural Opinion Leaders (COLs) emerged, gaining significant engagement on platforms such as Xiaohongshu.

Growth of the Xiaohongshu platform

Xiaohongshu, China’s answer to Instagram, is more relevant for travel than ever, according to Dragon Trail Research, with 36 percent of Chinese travelers using it in their outbound travel planning. It is the first stop for 64 percent of regular travelers who are Chinese Gen-Zers, who make up the vast majority of its 100 million monthly active users. This platform has evolved from a source of travel inspiration to the launch of its own travel agency. Xiaohongshu’s popularity among Gen Zers has surpassed that of traditional online travel agencies such as Trip and Fliggy.

China and UAE

China is one of the most important inbound tourism source markets for the UAE, consistently ranking among the top five source markets for Dubai over the last decade. Dubai Economy and Tourism CEO Issam Kazim confirmed at the Arabian Travel Market 2023 that Chinese visitors will continue to be a key focus for Dubai, and that campaigns and messaging in the market were maintained throughout the pandemic. China is the UAE’s largest non-oil partner, the GCC and China have a good political relationship, and business opportunities are expanding, with Chinese buyers ranking among the top five buyers of UAE residential real estate. Following the introduction of visa-on-arrival for Chinese tourists in 2016, the number of inbound Chinese visitors to the UAE increased significantly. Prior to the pandemic, Dubai had nearly 1 million Chinese visitors, and Abu Dhabi had over 400,000 Chinese visitors. The UAE was one of the first 20 countries the Chinese government allowed outbound tour groups to return, demonstrating the close relationship between the two countries.

Chinese visitors appear eager to return to the region. The UAE was named the 10th most popular country with Chinese tourists by Chinese travel website Mafengwo, and on WeChat, both Dubai and Abu Dhabi were at the top of the standings for regional and municipal tourism boards in the first quarter of 2023. The UAE’s appeal to Chinese luxury travelers is growing, making it one of the most appealing tourism market segments for destinations. Dubai has risen to eighth place from eleventh place on the list of popular travel destinations for Chinese High Net Worth Individuals (HNWI).

The UAE has a good reputation and strong connectivity, and it serves as an important hub for Chinese long-haul travelers traveling to Africa and Europe. The number of Chinese visitors to the UAE was expected to reach tens of thousands in the first quarter of 2023, thanks to direct flights to Abu Dhabi and Dubai. Emirates increased its operations in Guangzhou, Shanghai, and Beijing ahead of Chinese New Year, and has now restored flights to 85 percent of pre-pandemic levels. Etihad Airways is increasing weekly frequency on its Abu Dhabi-Shanghai route in Abu Dhabi. So there appears to be a strong demand from outbound Chinese tourists to return to the UAE, but is the region ready for their return?

China Readiness in UAE

As we mentioned in our Dubai ATM 2023 recap, experts believe the Dubai hospitality industry must be prepared for a surge in Chinese tourists following China’s reopening. JA Resorts’ Vice President of Operations, William Harley-Fleming, told ATM attendees that the company is working hard to be China-ready. Their definition of China readiness includes ensuring that their properties have Mandarin speakers as well as observing changes in the habits and patterns of Chinese travelers.

The availability of Mandarin speakers is critical because one of the major issues that Chinese tourists face, particularly the older generations, is a language barrier. Employing Chinese-speaking employees is critical to providing the best visitor experience to Chinese tourists. Fortunately, the UAE has 400,000 Chinese residents, making it one of the largest diasporas outside of East Asia. While this is likely to be covered in the hospitality industry, some touchpoints for independent travelers may necessitate some language focus. One example is transportation, where taxi drivers are unlikely to be Mandarin speakers at the moment. Filipinos, who have approximately 2 million Mandarin speakers and a well-established expat relationship with the UAE, could be a potential option for entities such as RTA and ITC. Another viable option is Nepal, which has made Mandarin mandatory in schools and has provided Chinese language training to tourism stakeholders even during the pandemic.

Some entities in the UAE have enlisted the assistance of subject matter experts in order to take note of the new habits of the Chinese traveler post-COVID. In January 2023, the Ras Al Khaimah Tourism Development Authority partnered with Welcome China (CBISN) to host a ‘China Ready workshop’ with their stakeholders to gain a better understanding of Chinese tourism. In Dubai, they have brought a taste of East Asia to downtown by redesigning a section of the first floor for an aesthetically pleasing Dubai Mall China Town, home to several Chinese brands and a food court that will appeal to the traditional food tastes of Chinese travelers.

Another critical aspect of Chinese tourist preparedness is the ability to meet their digital technological requirements. Presence on Super-apps such as WeChat, which has 1.3 billion monthly active users, is critical, as WeChat is now considered a way of life in China as a fully-fledged ecosystem. A WeChat Mini Program for UAE destinations, for example, Amsterdam Schiphol Airport partnering with WeChat to create a Mini Program to be their flagship ‘Smart Airport’ in Europe, could be extremely beneficial. Because mobile payments have become an inextricable part of Chinese consumer culture, providing the best visitor experience to Chinese tourists is essential. UAE retailers must ensure that not only China’s UnionPay credit cards, but also WeChat Pay and Alipay, are accepted by tourism service providers. Mashreq Bank currently provides WeChat Pay at select partners across the UAE, and while major retailers have undoubtedly adopted it, it is unclear how widely accepted it is across the entire UAE tourism ecosystem.

The next Golden Weekend of Chinese National Day in October will be the first major test of the UAE’s China readiness, with the return of Chinese outbound tourists a critical component of them meeting their ambitious tourism targets of 40 million hotel guests by 2031. It is critical that the needs of the new post-COVID Chinese tourist are reflected in the messaging and decision-making of UAE tourism stakeholders, and that this is combined with the famous Emirati hospitality to provide an experience worthy of a valued customer’s return.